THE END of "Healthcare Business as Usual"

We get to the bottom of what is driving healthcare need. In the past, management focused on the needs of employers and healthcare providers, insulating the end user- the patient. Employers shopping and cost shifting to the end user has forced healthcare companies to make decisions based on affordability. The better and needed healthcare service was many times "put off" because of cost. Chronic disease progressed and members got "sicker quicker." On the other hand, unnecessary healthcare testing drove costs higher to accommodate provider profit centers. These issues can be solved with our technology that manages your healthcare.

Employers, providers and employees are essential partners in the healthcare system. Now is the time to fully engage employees and dependents and develop solutions to help them be more educated and motivated users of healthcare. Two-thirds of the U.S. population remains overweight or obese. With 75% of a person's health status being attributed to behavioral choices, employers are footing the bill for decreased presenteeism, productivity and higher rates of absenteeism to the tune of $13,000 per hourly employee per year, demonstrating the traditional benefits and wellness models are not working.

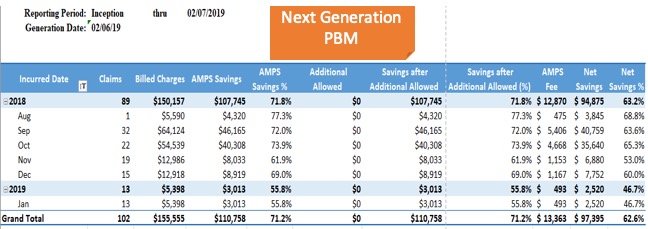

Fortunately, "Next Generation" benefits are available today; a combination of evidence-based science and technology provides a new approach to corporate benefits and wellness; one that takes a completely different and more productive path at initiating behavioral changes in employees.

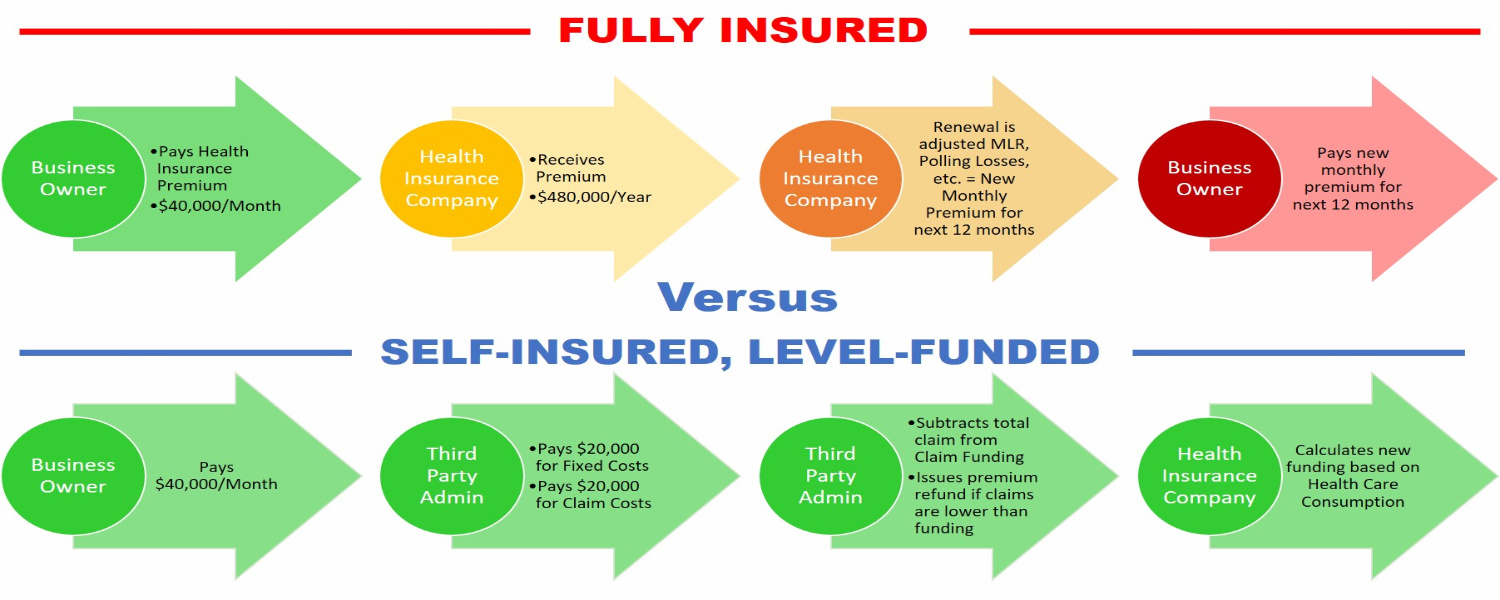

Integrated healthcare benefit analytics clearly identifies everyone's financial risk calculated from past claims data, predictive modeling, stop loss cost, deductible differences, stop loss limits and insurance costs. Risk tolerance can be selected by the employer, and detailed financial reporting is generated clearly illustrating the best choice in all the above categories.

Group Benefits Experts is not health insurance. We do not quote health insurance, spreadsheet results and cost shift to employees. We are aggregators, combining new "state of art" technology, products and analytical reporting, creating "Next Generation" benefit solutions. We work inside your health plan if your TPA relationship allows our technology to manage your plan. If your vender chooses not to include our technology we can introduce you to TPA's working with our technology.

We have invested 4 years into this very moment. We offer never seen before technology and strategies, creating benefits solutions for employers with 10 to 5,000 employees. We guide employers on how to save $1,000.00 to $2,000.00 per employee per year. No more shopping spread sheeting and cost shifting. Real strategies, long term planning and ACA compliant; something all employers are searching for.